- Success stories

- Client Scoring System and Internal Data Collection for Seller Capital

Client Scoring System and Internal Data Collection for Seller Capital

Seller Financing on Marketplaces

Project background

Overview

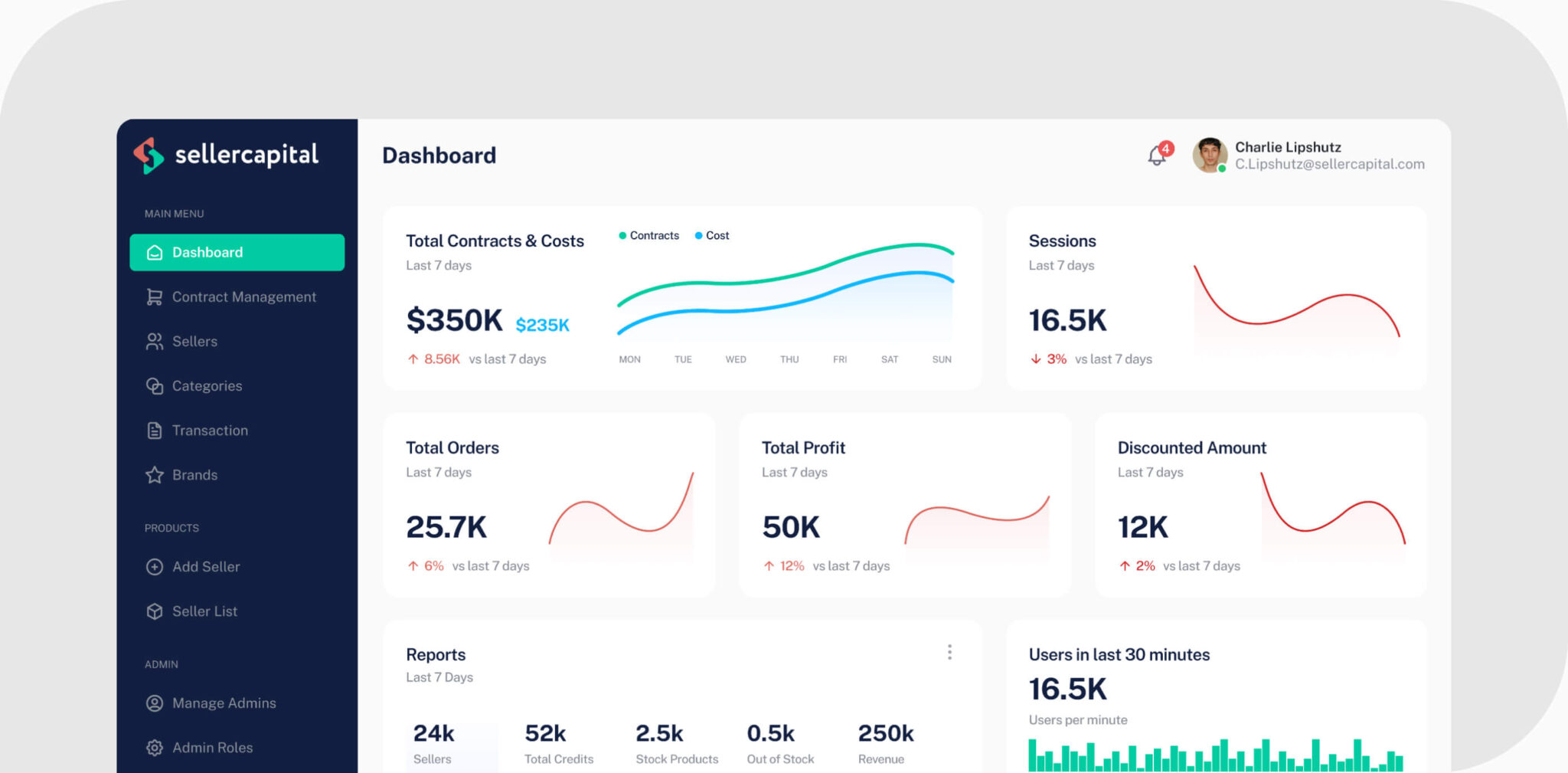

Seller Capital is a fintech company in Singapore offering renewable B2B credit lines to experienced merchants operating on various marketplaces. Their product focuses on providing continuous financing solutions to sellers without a specific repayment deadline. Sellers using the platform have been trading for over six months, and the platform applies a unique scoring system that evaluates more than 100 business markers, including market dynamics and projected profitability. Seller Capital needed an internal system to automate data collection and client scoring, enhancing their ability to offer credit and identifying top performers while eliminating underperformers. Our task was to improve integration with banks and services to increase automation and expand this system to streamline the financing process.

Project goals

- Integrate with financial institutions to facilitate real-time data collection and client scoring, improving decision-making.

- Provide seamless, automated workflows that could scale with the company’s growing seller base and support real-time financing.

- Webapp

- 3team members

- 400+hours spent

- Fintechdomain

Challenges

- Developing a complex scoring system that accurately evaluates more than 100 unique business markers, including market trends and forecasted profitability.

- Creating secure, efficient integrations with external banking systems and APIs while maintaining the integrity of sensitive financial data.

- Building a system capable of scaling as Seller Capital grows, allowing it to handle an increasing volume of applications.

Our approach

Solution

Collaborating closely with the client, we designed a robust architecture that allowed for seamless integration of external banking services and financial APIs. Throughout the development process, we maintained close communication with Seller Capital, using an Agile approach to ensure flexibility and quick adaptation to new requirements as they arose. This iterative process allowed us to continuously refine the system and address the evolving needs of the client, ensuring a smooth and scalable solution.

We implemented automated workflows that connected directly with external banking systems, pulling real-time data to facilitate decision-making and financing approvals. This new architecture provided Seller Capital with a flexible and scalable solution that could handle the growing number of merchants applying for credit. The microservices-based design ensured that each component worked independently, allowing for easier updates and maintenance.

Team

Our team consisted of a project manager and two highly skilled developers. Their expertise in C#, .NET, and microservices architecture allowed them to deliver an efficient and scalable solution.

Results

The project resulted in significant improvements to Seller Capital’s operational efficiency. The newly developed system enabled real-time processing of seller applications, reducing approval time by 50%. The integration with financial institutions streamlined the financing process, automating 80% of the workflow and positioning Seller Capital for continued growth in the fintech sector and e-commerce industry.

P.S. Check also one of our recent projects — developing a Cybersecurity Learning Platform for Individuals and Companies.

Valeriia Bystrova

Experienced IT consultant and lead generation manager. Created dozens of compelling case studies and blog posts related to software development services.

Tools and tech stack

More Projects

- retail

- dotnet

- staffaugmentation

- cybersecurity

- dotnet

- staffaugmentation